Risk Management: A Guide to ISO 31000

- Chegan SRM

- Feb 28, 2023

- 5 min read

Updated: Oct 19, 2023

ISO 31000 is an international standard developed by the International Organization for Standardization (ISO) that provides guidelines and tools for organizations to implement a risk management system. ISO 31000 is used by risk managers, organizations, and other stakeholders to manage risk and improve decision-making. It is widely used across a range of industries, including government, financial services, healthcare, energy, and manufacturing. It is also used by organizations of all sizes, from small businesses to large multinational corporations.

The standard was first published in 2009 and is intended to help organizations effectively identify, analyze, prioritize, and respond to risks. ISO 31000 is based on the principle that risk management should be an integral part of an organization's business process. It provides a framework for organizations to understand the risks they face, prioritize those risks, and develop plans to manage the risks. The standard encourages organizations to adopt a proactive approach to risk management, rather than a reactive one. ISO 31000 also provides guidance on how to integrate risk management into the organization's overall management system. ISO 31000 is applicable to all types and sizes of organizations.

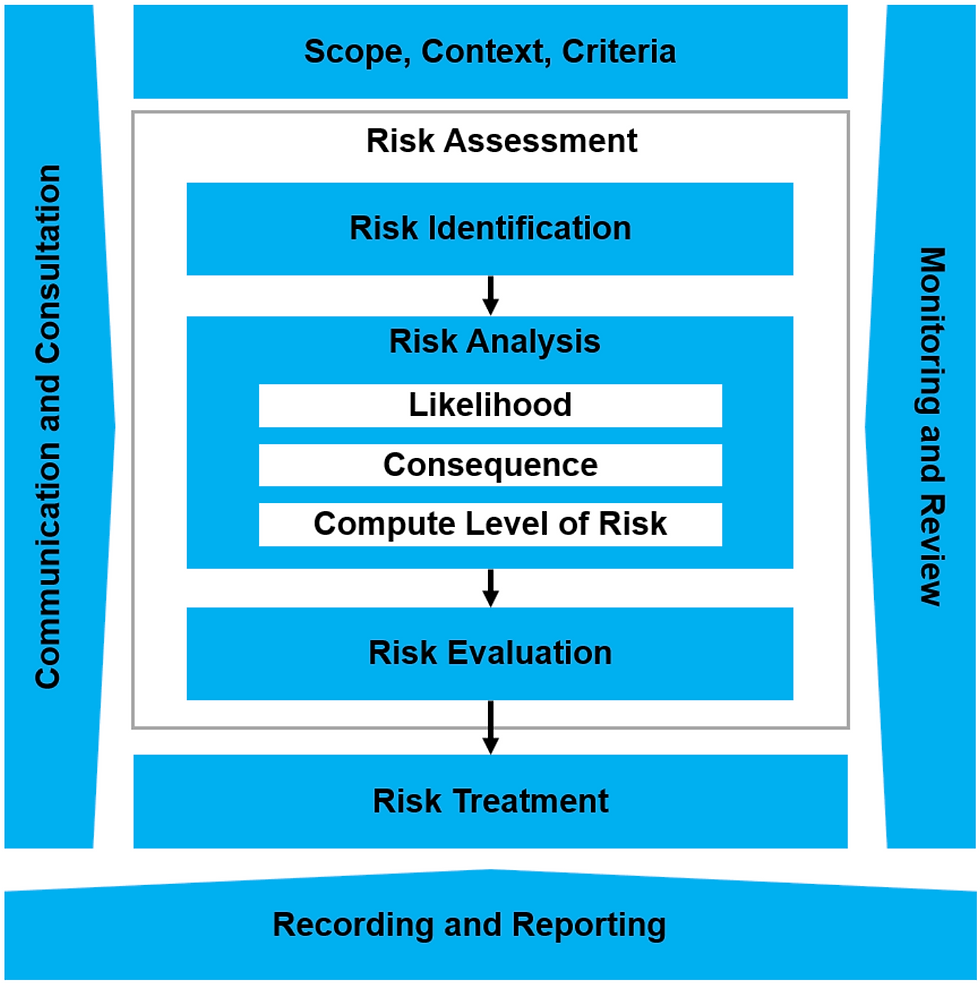

The Risk Management Process of ISO 31000 consists of eight main steps: Establishing the context, Identifying risks, Analyzing risks, Evaluating risks, Treating risks, Monitoring and reviewing, Communicating and consulting, and Reviewing the risk management process. These steps help organizations to accurately identify, analyze, prioritize, and respond to risks in a proactive and efficient manner. This enables organizations to reduce operational costs, gain confidence in their ability to take risks and try new approaches, and create a culture of risk management.

1. Establishing the context: This step involves setting the objectives and scope of the risk management process, defining stakeholders, and determining the risk criteria. The context of a situation is the set of circumstances that surround it and contribute to its meaning. It can include physical, environmental, temporal, emotional, and other factors. Establishing the context of a situation is important for understanding it and for making decisions about how to respond. This can involve gathering information about the environment, the people involved, the history of the situation, and any other relevant information. It can also involve understanding the dynamics of the situation, such as the power relationships between people and the underlying motivations for their actions. Establishing the context is important for making decisions that are based on an accurate understanding of the situation.

2. Identifying risks: This step involves identifying risks and hazards associated with a given situation. This can be done through brainstorming, research, and/or consulting with experts to identify potential risks. Identifying risk can include both internal and external risks, such as financial, operational, legal, and technological risks.

3. Analyzing risks: This step involves an assessment of the likelihood of the risks and their potential impact. This can be done by assessing the probability of the risk occurring and its potential consequences. This can usually take the form of a Risk Matrix– a tool used during risk assessment to evaluate the level of risk by comparing the probability or likelihood of an event occurring against the severity of the consequences that could be associated with it.

4. Evaluating risks: This step involves comparing the risks and their potential impacts to the risk criteria established earlier. Factors such as cost, probability, and potential impact are taken into consideration when evaluating risk. The goal is to identify, prioritize, and manage risks that could affect the organization in order to protect its assets and operations. This can include developing strategies to reduce the probability of the risk occurring, implementing plans to reduce the potential impact of the risk, and/or establishing a contingency plan in case the risk does occur.

5. Treating risks: This step involves selecting the most appropriate risk treatment options to address the risks. This is typically done using a structured risk management process.

- Avoiding Risk: The most straightforward way to treat risk is to avoid it altogether. This involves removing any potential hazard from the workplace or environment.

- Sharing Risk: The most common example of risk sharing is when an individual or a business purchases insurance to help share financial risk like property damage. Another example would be risk pooling where small businesses pool their resources together in a cooperative policy that will cover damages or loss if something happens to one of the members of the cooperative.

- Minimizing Risk: Another way to treat risk is to reduce or minimize the potential for harm by taking precautions. This could include providing protective clothing or equipment, or ensuring that workers are properly trained in the use of hazardous materials.

- Transferring Risk: Risk can also be transferred away from the organization by taking out insurance policies or entering into contractual agreements with third parties.

- Accepting Risk: In some cases, it may be necessary to accept the risk, particularly if the cost of avoiding or minimizing it is too high. In this scenario, the organization should ensure that they have the necessary safety measures and protocols in place to mitigate the risk as much as possible.

6. Monitoring and reviewing: This step involves monitoring and reviewing the risks on an ongoing basis to ensure that the risk treatments remain effective. Risk management should be constantly monitored and reviewed to ensure that any risks have been properly identified and addressed. The review should involve gathering and assessing updates on the risks, as well as verifying that the risk management strategies that were put in place are still effective. The review should also identify new risks or changes in existing risks, such as changes in the likelihood or impact of a risk. After the review is complete, any needed changes should be implemented.

7. Communicating and consulting: This step involves communicating the risks and their treatments to stakeholders and consulting them on the risk management process. Communicating and consulting risk involves informing people about potential risks and hazards associated with a certain activity and discussing the risks with people who may be affected, providing information to help them make an informed decision, and obtaining their input in order to create a plan of action to reduce the risk. It also involves consulting with experts and relevant stakeholders to ensure that all potential risks are understood and addressed.

See Also:

• AN INTERACTIVE EXCHANGE

8. Reviewing the risk management process: This step involves periodically reviewing the risk management process to ensure that it is effective and efficient.

This may involve looking at the risk management tools and techniques used, the risk management approach, the risk management policies and procedures, and the overall risk management results. The review should also assess the effectiveness of communication channels used in the process and identify any areas for improvement. This is an important part of the risk management process, as it ensures that the process is continually updated to reflect changing risk levels and circumstances.

ISO 31000 does not aim to get rid of all risks, as this is impossible. Instead, the ISO 31000 framework enables organizations to identify and manage risks effectively, leading to improved organizational resilience, increased efficiency, increased stakeholder confidence, better decision-making, increased innovation, and improved compliance. By proactively managing risks, organizations can reduce operational costs and gain confidence in their ability to take risks and try new approaches.

In conclusion, ISO 31000 provides organizations with a comprehensive framework for managing risks. By following the eight steps outlined in this standard, organizations can identify, analyze, prioritize, and respond to risks in an effective and efficient manner. The standard encourages organizations to adopt a proactive approach to risk management, rather than a reactive one, in order to reduce operational costs and gain confidence in their ability to take risks and try new approaches. Ultimately, ISO 31000 helps organizations create a culture of risk management, allowing them to make better decisions, increase efficiency, and enhance their resilience.

If you are looking for an effective risk management system that will help you reduce operational costs and gain confidence in your ability to take risks and try new approaches, ISO 31000 is the perfect solution for you. Contact us today to find out more about how ISO 31000 can help your organization.